Work Debate on the Legislative Initiative in Tax Policy Model

.jpg?token=b72ef2feccfcfbc48b57a66e9207b598)

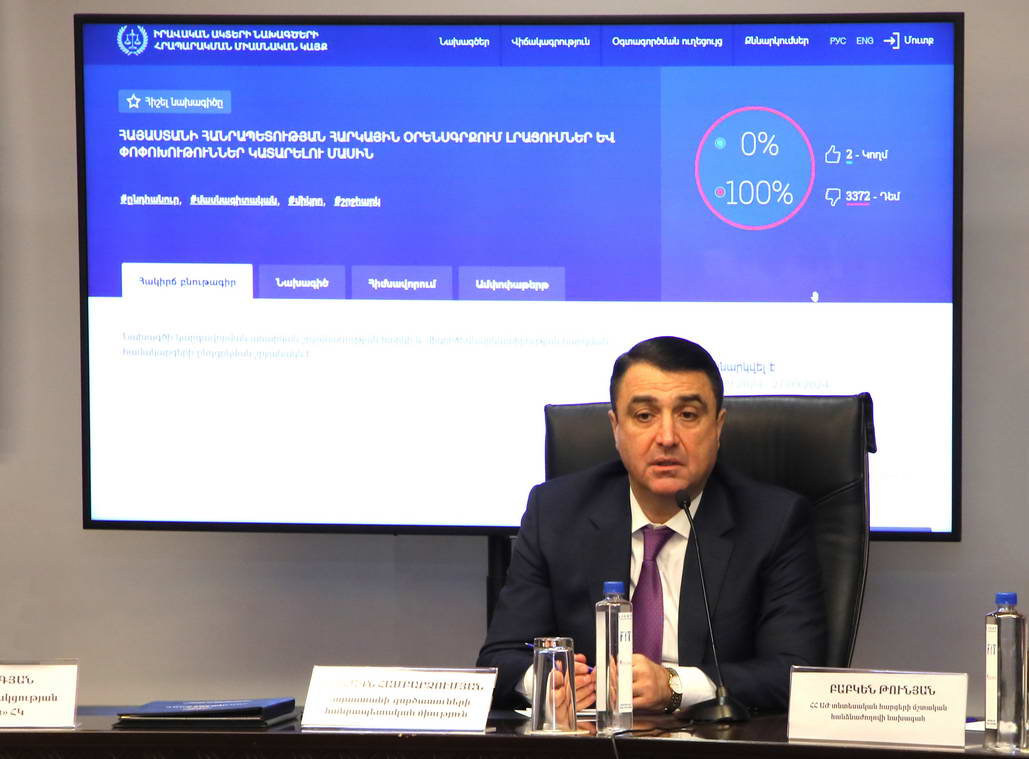

On November 29, at the joint initiative of Vahagn Hambardzumyan, President of the Republican Union of Employers of Armenia, Hakob Avagyan, President of the SME Cooperation Association NGO, and Karen Zadoyan, President of the Armenian Lawyers’ Association NGO, a public discussion was organized at the Elite Plaza Business Center. The discussion aimed to constructively and professionally address contentious issues related to the legislative initiative which proposes proposes to move the taxation of a number of professional works and services to the general taxation system from July 1, 2025.

Representatives from government agencies, public organizations, the SME sector, and mass media participated in the debate.

In his opening remarks, touching upon the necessity of holding work debates, Vahagn Hambardzumyan, the President of the Republican Union of Employers of Armenia, thanked the representatives of state agencies for accepting the invitation and participating in the constructive dialogue.

Speeches on the issue were made by Hakob Avagyan, President of the SME Cooperation Association NGO, Karen Zadoyan, President of the Armenian Lawyers’ Association NGO, Hasmik Harutyunyan, a Board Member of the Armenian Accountants Association NGO, Vahan Grigoryan, Chair of the Tax Committee of the Chamber of Auditors and Expert Accountants of Armenia and other invited speakers. They expressed concerns about the future operations of SMEs providing professional services, unfair competition, and issues related to the shadow economy.

SME representatives made a number of recommendations, including the issue of reviewing the implementation of the legislative initiative’s dates, delaying it until at least January 2026. They underlined the importance of using that period as effectively as possible to create specilized working groups to assess the impact of changes, develop and implement appropriate tools, as well as adapt enterprises.

Speeches were made by Babken Tunyan, Deputy Chair of the Standing Committee on Economic Affairs of the National Assembly of the Republic of Armenia, and Arman Poghosyan, Deputy Minister of Finance of the Republic of Armenia, who, sharing the concerns of the SME sector regarding the possible growth of the shadow economy, expressed their commitment to discuss the possibilities of joint work towards creating equal competitive conditions and developing a set of tools.

Following the conversation, all parties agreed to continue working discussions in a similar way and make amendments in the draft law. The ultimate goal of the legislation should be aimed at reducing the shadow economy and not increasing the tax burden. Therefore, first of all, the shadow economy should be eliminated, and then the new draft should be implemented, while the amendment should be postponed until January 1, 2026, so that it would be possible to develop and introduce the necessary toolkit within a year.

Summarizing the discussion, Vahagn Hambardzumyan highlighted its effectiveness, poining out that the RA National Assembly had already issued a statement stating that legal, accounting, and consulting services would be moved to the general taxation system, while other professions subject to the turnover tax would continue to operate under the general taxation system. However, this was contingent on the written settlement documents not being used as a basis for lowering the profit tax if the other party is a profit payer. This approach already makes sense, but it is already the focus of another discussion.

LATEST NEWS

-

15-05-2021The food security system can become a cornerstone for integrating and linking various sectors of the economy and becoming an alternative model for economic development. RUEA has been working with the World Food Programme in a multiphase assessment of Armenia’s food security system. On 5 February, 2021 we had a mini-conference to discuss the pillars around which food security system of Armenia can help develop the other sectors of the economy (we estimated at least 15 such sector linkages with food security).

-

05-10-2014The training courses, organized in the framework of ALIGN project, aimed to assist and support higher educational institutions of Armenia in the process of compliance the Educational Programs with National and Sectorial Educational requirements of Armenia. The trainings were developed in the framework of TEMPUS ARMENQA and INARM projects in accordance with the requirements of the European educational system.

-

27-02-2020In February 2020, a conference-discussion was held on "The importance of occupational safety and health for employers" organized by RUEA with the support of the International Labor Organization.

-

30-04-2021On 30 April 2021, three RUEA representatives attended a meeting on the progress of the “Resource Saving and Clean Production” (RSCP) component of the “EU for the Environment” program. The main purpose of the meeting was to demonstrate the possible application of RSCP practices based on food / agriculture, construction materials and chemical industry, as well as to receive suggestions on partnership opportunities with other interested organizations.

.jpg?token=8025eb434b4e59062e545fc9a6bfd0f4)

.jpg?token=eab5c8c15e5dd74392a64a3573d0fa0a)

.jpg?token=13b29dc42a0d1b123d77b33b63ccae6a)

.jpg?token=b8204d111cfc35e17dd27ae6feb09f9c)